As the global economy continues to evolve, understanding the intricacies of inflation and price fluctuations has become increasingly important for businesses, investors, and policymakers. One crucial tool in measuring inflation is the Producer Price Index (PPI), which provides valuable insights into the prices of goods and services at the production level. In this article, we will delve into the world of PPI, its significance, and how the Federal Reserve Economic Data (FRED) from the St. Louis Fed can help you make informed decisions.

What is the Producer Price Index (PPI)?

The Producer Price Index (PPI) is a measure of the average change in prices received by domestic producers for their output. It is calculated by the Bureau of Labor Statistics (BLS) and is considered a key indicator of inflationary pressures in the economy. The PPI measures the prices of goods and services at the production level, which can help predict future inflation trends. There are several types of PPI, including:

Final Demand PPI: Measures the prices of finished goods and services

Intermediate Demand PPI: Measures the prices of goods and services used as inputs in the production process

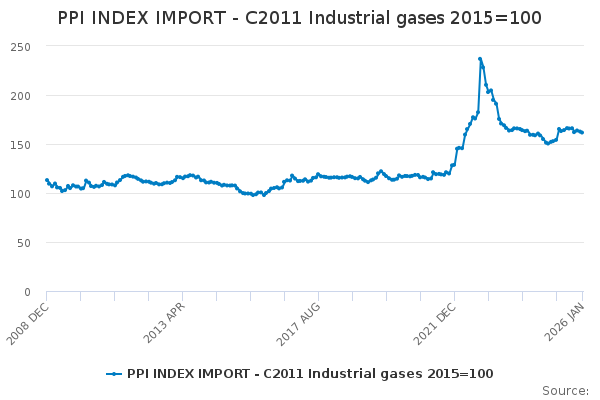

Crude Materials PPI: Measures the prices of raw materials and commodities

Why is PPI Important?

The PPI is an essential tool for businesses, investors, and policymakers because it provides:

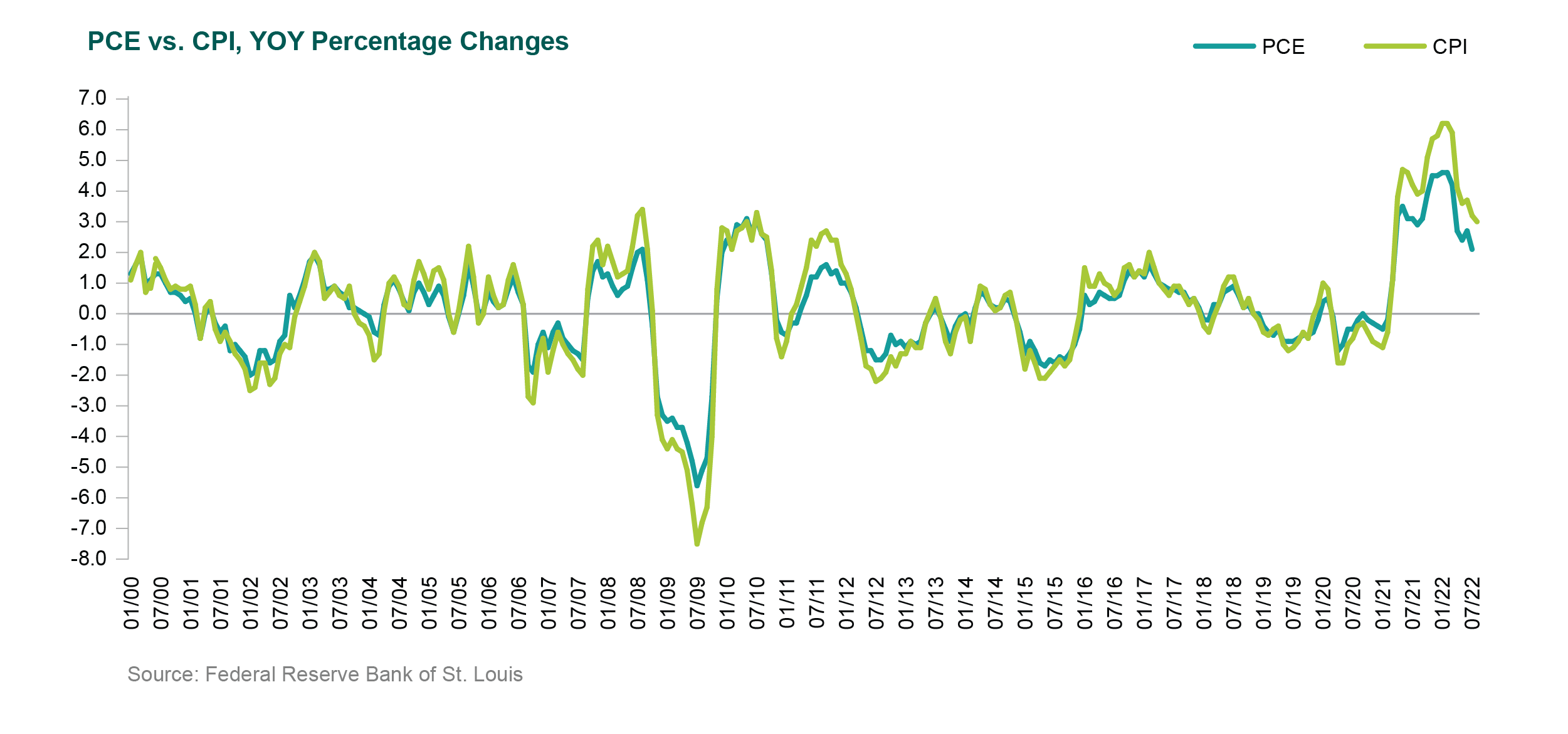

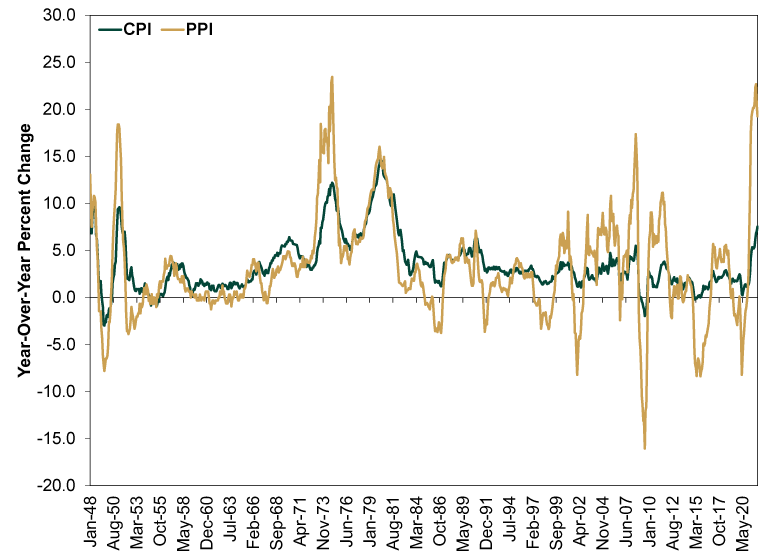

Early warning signs of inflation: Changes in PPI can indicate future inflation trends, allowing businesses to adjust their pricing strategies and investors to make informed investment decisions.

Insights into supply chain costs: PPI helps businesses understand the costs of production and make informed decisions about pricing and investment.

Monetary policy guidance: The PPI is closely watched by central banks, including the Federal Reserve, to inform monetary policy decisions.

Introducing FRED: The Ultimate Data Resource

The Federal Reserve Economic Data (FRED) is a comprehensive online database provided by the St. Louis Fed, offering a vast array of economic data, including PPI. FRED allows users to:

Access historical PPI data: Users can retrieve PPI data dating back to 1913, enabling them to analyze long-term trends and patterns.

Customize data views: FRED's interactive tools enable users to create customized charts, graphs, and tables to suit their specific needs.

Stay up-to-date with real-time data: FRED provides timely updates on PPI releases, ensuring users have the latest information to inform their decisions.

In conclusion, the Producer Price Index (PPI) is a vital tool for understanding inflation and price fluctuations in the economy. By utilizing the Federal Reserve Economic Data (FRED) from the St. Louis Fed, users can access a wealth of information on PPI, including historical data, customizable charts, and real-time updates. Whether you're a business owner, investor, or policymaker, understanding PPI and leveraging FRED's resources can help you make informed decisions and stay ahead of the curve in today's fast-paced economic landscape.

By incorporating PPI and FRED into your economic toolkit, you'll be better equipped to navigate the complexities of the global economy and unlock new opportunities for growth and success. So why wait? Explore the world of PPI and FRED today and discover the secrets to making informed decisions in an ever-changing economic environment.